Running a business involves juggling multiple things at once, and for many, billing and bookkeeping can often seem too challenging. However, managing your finances doesn't have to be complicated or overwhelming. With the right strategies, you can simplify these processes.

Whether it's embracing digital invoicing, automating payments, or hiring part-time bookkeepers, there are practical methods that can make your financial management more efficient. Keep reading as we delve into easy ways to simplify billing and bookkeeping for your business.

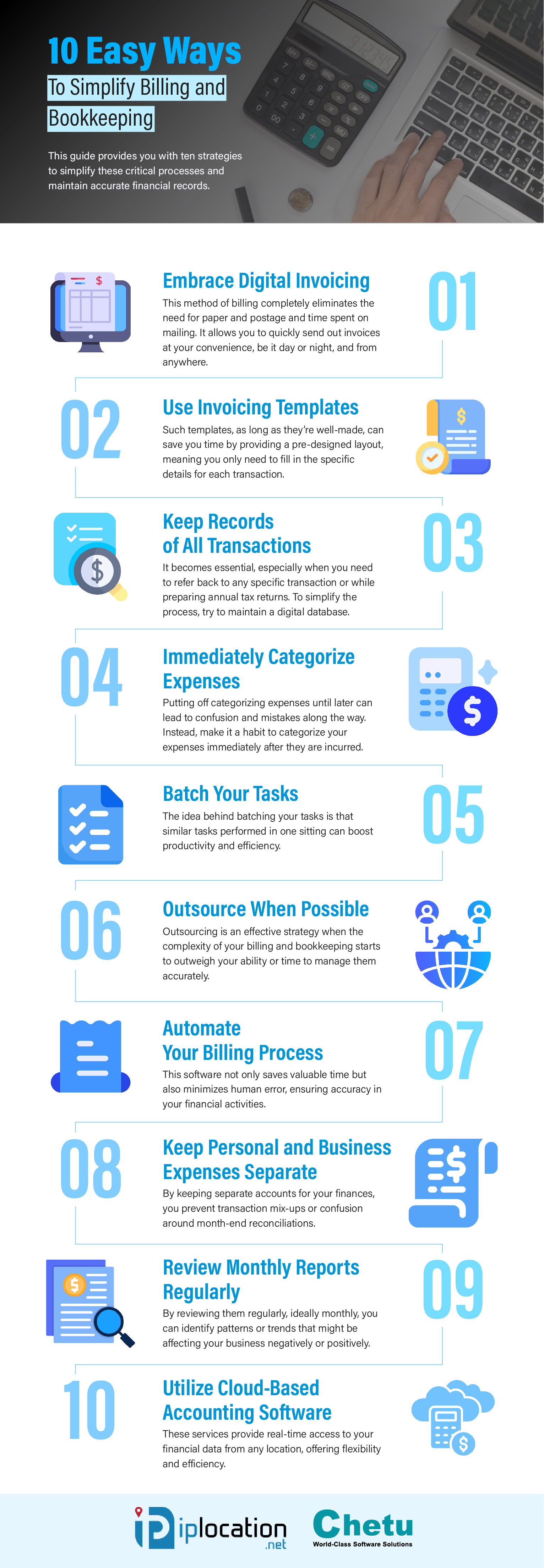

10 Easy Ways to Simplify Billing and Bookkeeping

Managing finances can be a challenging task for many businesses. This guide provides you with ten strategies to simplify these critical processes and maintain accurate financial records.

1. Embrace Digital Invoicing

Embracing digital invoicing is pivotal in simplifying your billing process. This method of billing completely eliminates the need for paper and postage and time spent on mailing. It allows you to quickly send out invoices at your convenience, be it day or night, and from anywhere.

Tools such as PayPal or Stripe offer easy-to-use invoicing systems that can handle multiple currencies and many payment methods. Furthermore, digital invoices are easier to track and secure, reducing the risk of losing crucial financial documents when you need them most. If you're simply looking to generate an invoice, you may also try our free invoice maker tool.

2. Use Invoicing Templates

The use of invoice templates is certainly one effective way to simplify your business's billing process. Such templates, as long as they’re well-made, can save you time by providing a pre-designed layout, meaning you only need to fill in the specific details for each transaction.

If you prefer using familiar software like Microsoft Office, you can utilize Word templates for invoices. These ready-made formats are easy to modify based on your brand and customer needs. They are not only a quick solution but also preserve that professional look.

3. Keep Records of All Transactions

Maintaining a record of all business transactions is the cornerstone of effective bookkeeping. It becomes essential, especially when you need to refer back to any specific transaction or while preparing annual tax returns. To simplify the process, try to maintain a digital database.

This database should include categorized transactions. Apps like QuickBooks allow you to easily input and track each transaction in real-time. With organized records at your fingertips, uncertainty diminishes, and managing your finances becomes significantly less daunting.

4. Immediately Categorize Expenses

In the realm of bookkeeping and accounting, procrastination can be your worst enemy. Putting off categorizing expenses until later can lead to confusion and mistakes along the way. Instead, make it a habit to categorize your expenses immediately after they are incurred.

By doing so, you will be able to keep a clear insight into where your money is going and identify potential areas for saving. Using digital resources like Mint or Expensify allows you to categorize expenses, which simplifies bookkeeping, reduces stress levels, and keeps finances on track.

5. Batch Your Tasks

The idea behind batching your tasks is that similar tasks performed in one sitting can boost productivity and efficiency. For example, if you're processing invoices, perform all related activities together, like categorizing them or sending digital copies, all at once.

Batching minimizes distraction and idle time between tasks, creating a streamlined workflow. Integrating this approach into your routine will help you maintain a clear focus on financial management, saving you considerable time and mental resources over the long run.

6. Outsource When Possible

Outsourcing is an effective strategy when the complexity of your billing and bookkeeping starts to outweigh your ability or time to manage them accurately. Trusted specialized services can take on these financial tasks, freeing you to focus more on the core operations of your business.

This does not mean abdicating responsibility; you still maintain oversight, but without getting lost in tedious daily management. Firms like Bench or Pilot offer such services, providing expert assistance while also offering access to top-notch bookkeeping tools.

7. Automate Your Billing Process

Invest in billing software that allows you to automatically generate and send invoices and reminders for unpaid bills or recurring expenses. This software not only saves valuable time but also minimizes human error, ensuring accuracy in your financial activities.

Automation tools such as FreshBooks or Bill.com offer comprehensive solutions, from time tracking to multi-currency support, making the whole process simpler and more efficient. By incorporating automation, you'll gain a seamless system that frees you up for other tasks.

8. Keep Personal and Business Expenses Separate

A separation between personal and business expenses allows for a clear understanding of your business’s financial health and makes tax filing easier. By keeping separate accounts for your finances, you prevent transaction mix-ups or confusion around month-end reconciliations.

Furthermore, this segregation aids in ensuring compliance with tax regulations and provides accurate financial statements when required by potential investors or lenders. In simple terms, separate accounts create less of a hassle and provide a clearer financial picture.

9. Review Monthly Reports Regularly

Monthly financial reports provide an overview of your financial situation, including income, expenses, and overall profitability. By reviewing them regularly, ideally monthly, you can identify patterns or trends that might be affecting your business negatively or positively.

Also, spotting irregularities becomes easier, which can save you from potential financial missteps. Utilizing software to create these reports simplifies this process by providing insightful data at a glance. This monitoring will lead to informed decision-making that leads to growth.

10. Utilize Cloud-Based Accounting Software

Utilizing cloud-based accounting software is a game-changer for everyone seeking to simplify their billing and bookkeeping process from the very beginning. These services provide real-time access to your financial data from any location, offering flexibility and efficiency.

This allows you to send invoices, reconcile accounts, or check cash flows even when you're not in the office. Additionally, cloud-based software provides a secure platform for your financial data with regular backups, ensuring no loss of critical information or customer data.

Conclusion

Adopting these strategies can take the stress out of billing and bookkeeping, making them more efficient and manageable. Remember, the goal isn't just to simplify these tasks but also to maximize your time toward growing your business. Start by incorporating an easy-to-use accounting software or schedule regular audits. Little steps make a big difference over time.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment