Finding the right tech stack and right talent can make or break your payment app success. The number of mobile payment users is vast and growing with estimates suggesting over 2.6 billion active users across various payment apps in 2024, with projections showing this will exceed $1 trillion by 2027. For entrepreneurs, marketers, and application users, one burning question remains: how much does it cost to hire mobile app developers? Knowing the forefront costs not only outlines your budget plan smartly but also places you for better growth.

In this guide, we have wrapped the trending features, what kind of app you should build by targeting different categories and users, step by step guide to build, and non-negotiable security and compliance. This will help you find excellent Mobile developers at the right cost. Let’s explore!

Key Takeaways

- Digital payments are revolutionizing the market, which also creates massive opportunities for businesses and entrepreneurs.

- Security is a necessity, PCI DSS compliance, data encryption, biometrics, advanced fraud detection and scalable tech stack are non-negotiable.

- The cost of payment app development ranges between $40,000 - $400,000 for basic to advanced apps. For enterprise grade apps the cost can exceed even $600,000.

- Monetization models should be a part of your payment model application, which also works for long term success.

- The digital payments are evolving with new features including AI, biometrics, and real time processing.

What kind of App Is This?

Before you think about building a digital payment app, you need to first analyse the pain points. What problem will your application solve? What type of payment app actually do you want? Because the market needs are growing with new and modern technology and trends and there are existing apps which still fail to solve the problems, but it is a full opportunity if you find your right niche. Thus this initial thinking is the crucial factor of your digital payment app development service.

Below are the types of payment applications and their specific functions to help you make an informed and strategic decision.

- Peer to peer payment apps; These apps are used for personal transactions, which come with a limit amount of transactions in one day for eg, PayPal, Cash App.

- Mobile Wallets : These wallets are used for small and immediate transactions, for eg; Apple Pay, Google Wallet, Samsung Pay.

- Ecommerce Payments Systems : These payment applications are used for stores where they sell goods and services through an online store, for eg: Shopify Payments, WooCommerce Stripe.

- Cryptocurrency Payment Apps : These apps facilitate transactions using digital currencies such as Bitcoin, or Ethereum. There are some existing apps in the market like Coinbase, Binance and BitPay.

- Buy now and Pay later: Allow users to make purchases and pay later in installments, such as, Afterpay, Klarna Affirm.

- Digital Banking Apps: Offers full banking services, from loans to payment services, these applications are mostly used by users who avoid frequent going to bank and to avoid wasting long hours, for eg: Revolut, N26, Monzo.

- Subscription Payment Apps: These payment applications manage subscription based services, features like auto pay transaction, for eg Netflix, Spotify, Hulu.

- QR Code Payment Apps: Use QR codes to facilitate quick, contactless payments between buyers and sellers, such as WeChat Pay, PhonePay.

- International Payment Apps: Enables cross border transactions and currency conversions, such as TransferWise, Remitly, WorldRemit.

- Charity Donation Apps: Allow users to donate money to charitable causes through their mobile phones, such as, GoFundMe, JustGiving.

- Micro Payment Apps: Handles small payments, often for digital content like apps, music, or games such as Google Playstore, Steam.

- Utility Payment Apps: Facilitates payments for utilities like water, electricity and internet bills, for eg, Paytm, BillDesk.

- Unified Payments Interface: Facilitates real time inter bank payments, linking multiple banking accounts into one platform for fast seamless transactions, such as, Google Pay, Phonepay, Paytm.

- Super Apps: Offers beyond services like food delivery, internet bills, loans, social networking and more, such as, WeChat, Paytm.

Step-by-Step Process for Building Payment App

Crafting a breakthrough and successful application which aligns with users needs and goals, and aligning with modern features, offers solutions to the issues which also make your application stand out in a competitive market. Each phase builds on the previous one, creating a roadmap from concept to launch. Here are the key steps to craft a payment app:

1. Research, Analysis and Planning

Initially phase of building an payment needs a thorough research about market and user preference, identify opportunities and gaps in existing solutions, what issues do current apps solve poorly? This analysis report helps you innovatively and think differently about your application, how your payment app will enhance the users to use more.

You can also gather research based surveys to know the users perspective, which will help your application support in crafting applications with ease.

2. Selecting the Right Model

Development approach significantly impacts both cost and timeline. In house development provides maximum control but requires significant investment in talent acquisition and retention. The need for engineers with blockchain, security, AI fraud detection and compliance expertise can grow your overall payment app development cost significantly.

Whereas, outsourcing reduces the cost and timeline provides access to specialized expertise. Successful outsourcing needs careful vendor selection and project management.

Talking about Hybrid Model, this model combines both inhouse as well outsource. This approach is increasingly becoming popular for complex projects.

3. Designing the UI/UX and App Architecture

You know what’s most important in mobile app development? The website, which plays a centric role for attracting more users to the applications, hires UI/UX designers who help you create an innovative user interface that feels natural to use.

4. Development Phase

Development typically follows agile methodologies with combining both frontend as well as backend development which enables to create server side logic and builds the user interface which integrates with backend services for mobile app development service and web app development service by sharing consistent design, performance, and functionality.

5. Testing

Payments app requires extensive testing due to security and financial implications. Functional, security, performance and compliance testing which includes verifies all features, testing, code analysis and verifies adherence to PCI DSS.

6. Deployment

After rigorous testing, the app is ready to deploy. The developers now deploy the application on cross platform applications such as App store and Google play store. Regulatory Approval may be required depending on app functionality and target markets.

7. Post Launch Maintenance

Payment apps require ongoing maintenance and updates which includes security, feature, compliance and performance optimization. This maintenance ensures that your apps are functioning smoothly without any glitches.

Key Features of a Payment Application: What’s Essential and What’s Not?

When we talk about features, we are actually talking about core features which enhance more trust amongst users and support long term success. Let’s know some of the core features which advance your applications without confusing your users.

Core Features

Every payment application absolutely needs these fundamental features to solve the basic needs of users.

- Account Linking: This feature adds on to your application which includes connection of bank accounts, credit cards, and debit cards securely. Also, helps in real time verifications.

- Money Transfer: This will be your core feature which allows users to send, receive and request payments easily. Plus, including transaction history and contact integration.

- User Registration and Authentication: This feature includes all the personal information of users like email, phone verification, password setup, profile creation and biometric authentication, including all the information related to users just like Personalize Dashboard.

- Security: This app feels trust amongst users, where apps allow users to set up PIN, Two factor authentication.

- Transaction History: It records all the past transactional history, where users can easily access and view their amount spent when and where. Additionally, Functionality, filters, and export options separate good apps from great ones.

- QR Code: Scanner features enable contactless transactions everywhere. Users scan codes to pay at physical locations. Makes your app useful beyond peer to peer transfers.

- Push Notifications: This feature keeps updated users about every transaction through mails, text or via call.

- AI Chatbot Assistance: These AI assistance chatbots handle basic issues of users instantly while complex issues are handled by human staff.

- KYC Verification: For identifying confirmation meets regulatory requirements. Document upload, selfie verification, and address confirmation are standard now.

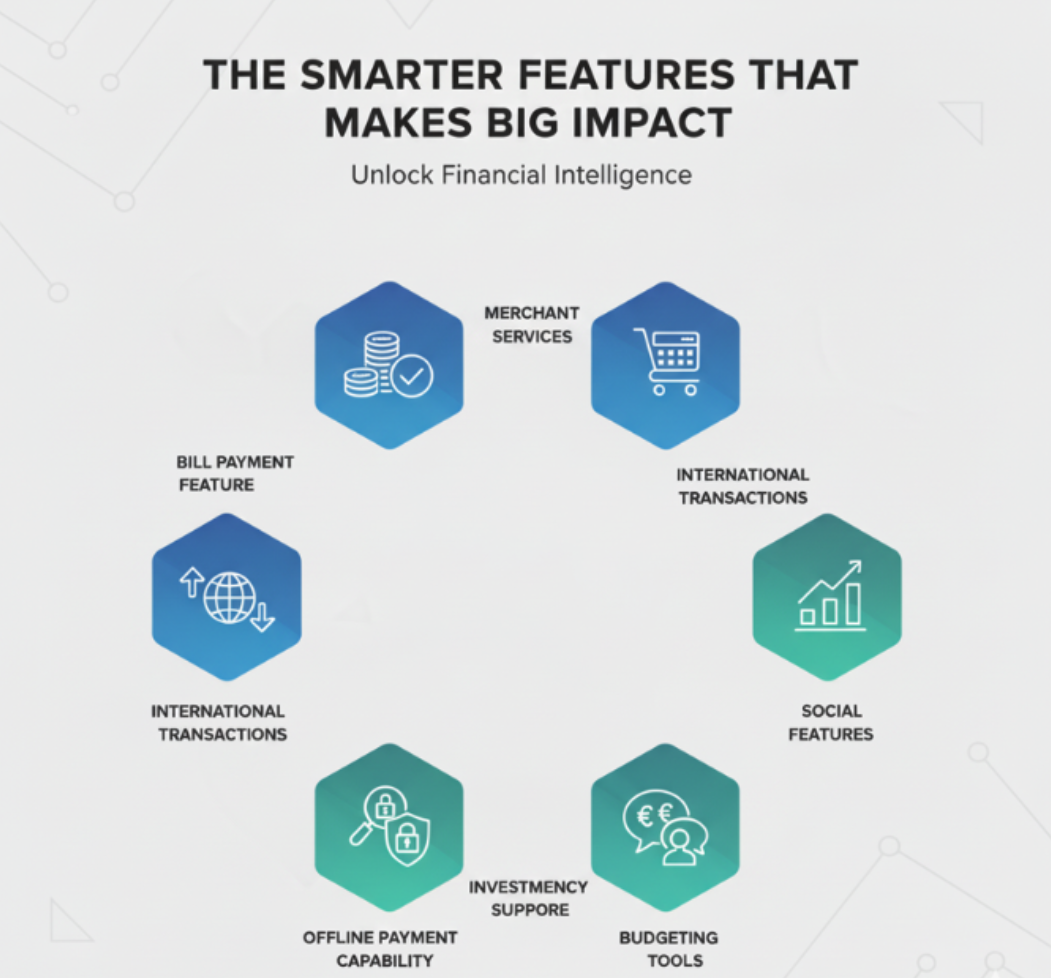

The Smarter Features that Makes Big Impact

Advanced payments apps includes next level functionality that drives users and increases retention rates:

- Bill Payment: This API integration lets users pay their utilities, rent, and recurring expenses directly. This feature brings back the user to the application.

- Merchant Services: enables businesses to accept payments through your platform. Point of sale integration, inventory management, and sales analytics become revenue drivers.

- International Transaction: These features expand utility for global users, which also requires compliance with international regulations plus currency conversion capabilities.

- Investment Feature: This allows buying stocks, bonds, and crypto directly from the payment balance. Converts simple apps into comprehensive financial platforms.

- Offline Payment Capability: It works when the internet connection is spotty. Store transaction data locally and sync when the connection returns.

- Multi Currency Support: This feature handles different currencies for international users and travelers.

- Social Features: There are platforms where we have to pay for subscription, where we can split the bill with group and payments requests through social media integration. Makes payments feel more natural and social.

- AI fraud detection: This AI powered fraud detection enables users to get notified in advance about any malfunctioning or practices which alerts the users for taking an action.

- Budgeting Tools: This feature will be added on to the application as due to the fast paced world, users don’t have time to navigate their budgetary plans and review it, this feature helps users track spending patterns and set financial goals.

Conclusion

Creating a successful payment app needs a team who understand both the technical complexities and the business realities of financial app development. So, don’t just rely upon coding skills but try to craft an app which takes care of every minute transaction no matter whether your users are using it for national, or international transactions. Just create an API integration such that it welcomes all the payment related solutions.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment